05 Sep 2025

The AI Supercycle™ Report: Infrastructure inflection point, shifting sentiment, and record fundraising

Key Takeaways:

- AI Infrastructure at an Inflection Point: From warnings on energy consumption and regulatory strain to SK Hynix’s bullish forecast on memory demand, the physical backbone of AI is scaling fast—but also straining power grids, supply chains, and policymakers.

- Shifting Investor Sentiment: AMD’s analyst upgrade highlights growing confidence in challengers to Nvidia, yet some cautionary reports assert that commercial returns are lagging behind capital inflows. The gap between hype and revenue remains a key risk factor.

- Capital Concentration and Long-Term Impact: Record AI fundraising continues, but exits remain limited. Investors should prepare for a market dominated by a handful of well-funded leaders while broader adoption plays out over a longer horizon.

Quote of the Week:

“Let’s start with the idea that AI is a transformative force and the value really accrues to companies that have existing customers and data, because they can actually be beneficiaries of applied AI. Organizations that have the culture and courage to transform themselves will be strengthened by AI; organizations that don’t will be left behind. It starts with that theory of change.”

— Hemant Taneja, CEO of General Catalyst

Top 5: AI in the Headlines

AI is moving fast—so are the investment opportunities. The AI Supercycle™ Report highlights the key recent developments that AI investors interested in capturing the entire supply chain need to know. The report also includes examples of companies well-positioned to capitalize on these trends, as well as the Chart of the Week.

1. McKinsey: The Data Center Balance

- Why It Matters: McKinsey highlights how U.S. states face both opportunities and challenges as AI-driven data center growth accelerates. Energy demand, land use, and regulatory hurdles are colliding with a surge in investment from hyperscalers. Policymakers will need to balance local economic benefits with environmental and infrastructure pressures.

- Key Quote: “Data centers could account for up to 9% of U.S. electricity demand by 2030, up from about 4% today, underscoring the scale of the AI infrastructure boom.”

2. IBD: AMD Stock Upgraded to Buy. What Caused the Change in Sentiment?

- Why It Matters: AMD stock was upgraded to “Buy” after analysts cited strong traction for the company’s MI355 AI accelerators among hyperscale cloud providers. The move signals rising investor confidence in AMD’s ability to challenge Nvidia in the high-performance GPU market. Projections call for meaningful share gains in data center AI workloads over the next several years.

- Key Quote: “Hyperscale data-center customers are working more closely with AMD. They are now expressing true interest in deploying AMD at scale.”

- Stock Exposure: AIS includes Advanced Micro Devices (AMD), a direct beneficiary of the expanding GPU market for training and inference.

3. The Guardian: Is the AI Boom Finally Starting to Slow Down?

- Why It Matters: Despite massive capital inflows, evidence is emerging that AI adoption may not yet be producing proportional revenue gains. An MIT study cited by the article found that 95% of generative AI projects had not generated material revenue impact. Coupled with cautious commentary from leading AI players, investors are beginning to question whether AI valuations are outpacing near-term fundamentals.

- Key Quote: “The AI sector is in danger of becoming a hype cycle, with more projects chasing headlines than delivering commercial returns.”

4. Reuters: SK Hynix Expects AI Memory Market to Grow 30% a Year till 2030

- Why It Matters: SK Hynix projects the market for high-bandwidth memory (HBM) will expand at a 30% annual rate through the end of the decade. As the leading supplier of HBM to Nvidia and other chipmakers, SK Hynix is well-positioned to benefit from surging demand for AI model training and inference. Memory has become a bottleneck in AI scalability, making it one of the most critical components of the ecosystem.

- Key Quote: “The AI-driven memory market is set to triple in size by 2030, as demand for high-bandwidth solutions surges.”

- Stock Exposure: AIS includes SK Hynix (000660 KS), a global leader in AI memory technology and a key supplier to Nvidia.

5. Crunchbase: As Funding to AI Startups Increases and Concentrates, Which Investors Have Led?

- Why It Matters: AI-related companies have raised a staggering $118 billion as of mid-August 2025, surpassing the entire 2024 total of $108 billion and representing nearly half of global venture funding this year. This surge highlights increasing concentration, with just eight companies accounting for 62% of the funds, driven by major investors like SoftBank and corporate giants such as Meta and Google.

- Key Quote: “As AI companies demonstrate stellar growth, investors will continue to compete to invest in large rounds at huge valuations.”

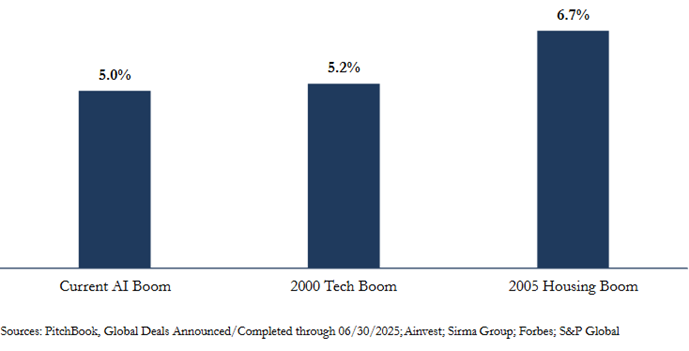

Chart of the Week: Booms and Investment Spend as % of U.S. GDP

Closing Insights

AI’s momentum is defined by contrasts: infrastructure buildouts scaling at unprecedented speed, investor enthusiasm reaching new highs, and a market still wrestling with uneven commercial outcomes. The tension between capital inflows and real-world adoption is shaping the trajectory of the AI Supercycle™.

At the same time, competition is intensifying across the supply chain. AMD’s rise as a credible GPU alternative, SK Hynix’s dominance in high-bandwidth memory, and the policy challenges outlined by McKinsey all point to a future where success hinges on efficiency, power availability, and scalability. The companies enabling this backbone are increasingly being rewarded in public markets, even as private valuations chase momentum.

###

At VistaShares, we see the AI Supercycle™ not as a straight line but as a layered buildout—where chips, memory, and infrastructure remain the critical foundation. Long-term investors will be best positioned by maintaining exposure across the full AI stack, from semiconductors to data centers to the systems that make scaling possible.

The VistaShares Artificial Intelligence Supercycle ETF™ (AIS) offers Pure Exposure™ to the ecosystem powering the AI revolution. Whether it’s memory capacity, power optimization, or hyperscale deployment, AIS is designed to capture the infrastructure layer that’s enabling AI to scale from labs to everyday life.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (844) 875-2288. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal

For the VistaShares Artificial Intelligence Supercycle ETF (AIS) top holdings & fund details, please visit: https://www.vistashares.com/etf/ais/#holding

Artificial Intelligence Risk. Issuers engaged in artificial intelligence typically have high research and capital expenditures and, as a result, their profitability can vary widely, if they are profitable at all. The space in which they are engaged is highly competitive and issuers’ products and services may become obsolete very quickly. These companies are heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights.

Equity Market Risk. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers.

Technology Sector Risks. The Fund will invest substantially in companies in the technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments.

Foreign Securities Risk. Investments in securities or other instruments of non-U.S. issuers involve certain risks not involved in domestic investments and may experience more rapid and extreme changes in value than investments in securities of U.S. companies.

Index Strategy Risk. The Fund’s strategy is linked to an Index maintained by the Index Provider that exercises complete control over the Index.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have an extensive track record or history on which to base their investment decisions.

Foreside Fund Services, LLC, distributor.