25 Dec 2025

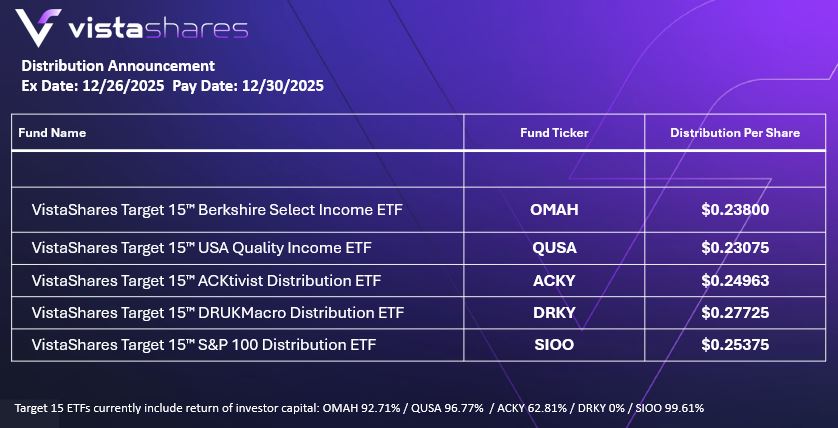

VistaShares Announces Distributions For Target 15™ Family ETFs: SIOO, DRKY, ACKY, OMAH, QUSA

NEW YORK & SAN FRANCISCO & BOSTON (December 26, 2025) –

VistaShares, an innovative asset manager seeking to disrupt the status quo in thematic exposures, income investing, and more, is today announcing the distribution amounts for all 8 of its ETFs: VistaShares Target 15 S&P 100 Distribution ETF, VistaShares Target 15 DRUKMacro Distribution ETF (DRKY), VistaShares Target 15 ACKtivist Distribution ETF (ACKY), VistaShares Target 15™ Berkshire Select Income ETF (OMAH), and VistaShares Target 15 USA Quality Income ETF (QUSA).

Distributions for Target 15™ Funds currently include a return of investor capital. ROC: OMAH 92.71% / QUSA 96.77% / ACKY 62.81% / DRKY 0% / SIOO 99.61%

For more information and updates from VistaShares, please visit www.VistaShares.com and follow the firm on LinkedIn @VistaShares, and on X @VistaSharesX.

About VistaShares

At VistaShares, we strive to deliver innovative investment solutions for today’s investors, helping them navigate evolving market opportunities with confidence. VistaShares ETFs are actively managed by industry and investment experts, offering two distinct strategies. Our Pure Exposure™ ETFs target technology-driven economic Supercycles® that we believe are poised for significant growth. Additionally, our Target 15™ option-based income ETFs are designed to generate high monthly income while complementing a core equity portfolio.

The Distribution rate for Target 15 ETFs is the estimated payout an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. The Distribution Rate is calculated by multiplying an ETF’s Distribution per Share by twelve (12), and dividing the resulting amount by the ETF’s most recent NAV. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Distributions are not guaranteed.

The Distribution rate and 30-Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may differ significantly from its Distribution Rate or 30-Day SEC Yield. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs (if any) are variable and may vary significantly from month to month and may be zero. Accordingly, the Distribution Rate and 30-Day SEC Yield will change over time, and such change may be significant. The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment. These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future.

Index / Strategy Risks. The Index’s holdings are derived from publicly available data, which may be delayed relative to the then current portfolio of S&P 100. Consequently, the Fund’s holdings, which are based on the Index, may not accurately reflect their most recent publicly-disclosed investment positions and may deviate substantially from its actual current Portfolio. The equity securities represented in the Index are subject to a range of risks, including, but not limited to, fluctuations in Market conditions, increased competition, and evolving regulatory environments, all of which could adversely affect their performance.

Focused Portfolio Risk. The Fund will hold a relatively focused portfolio that may contain exposure to the securities of fewer issuers than the portfolios of other ETFs. Holding a relatively concentrated portfolio may increase the risk that the value of the Fund could go down because of the poor performance of one or a few investments.

Distribution Risk. Although the Fund has an annual income target, the Fund intends to distribute income on a monthly basis. There is no assurance that the Fund will make a distribution in any given month.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes.

Options Contracts Risk. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the option contract and economic events.

Equity Market Risk. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value.

U.S. Government and U.S. Agency Obligations Risk. The Fund may invest in securities issued by the U.S. government or its agencies or instrumentalities. U.S. Government obligations include securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, such as the U.S. Treasury.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective Investors do not have a track record or history on which to base their investment decisions.

Newer Sub-Adviser Risk. VistaShares is a recently formed entity and has limited experience with managing an exchange-traded fund, which may limit the Sub-Adviser’s effectiveness.

Swap Agreements Risk: Swap agreements are entered into primarily with major global financial institutions for a specified period which may range from one day to more than one year. In a standard swap transaction, two parties agree to exchange the return (or differentials in rates of return) earned or realized on particular predetermined reference or underlying securities or instruments.

High Monthly Income Disclosure: There is no guarantee of how the Fund will perform in the future. There is no assurance the Fund will make a distribution in any given month and the following may vary greatly.

30-Day SEC Yield: The 30-Day SEC Yield represents net investment income, which excludes option income, earned by the Fund over the 30-Day period ended at the most recent month-end, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-Day period.

Distribution Rate: The annual rate an investor would receive if the most recent fund distribution remained the same going forward. The Distribution Rate represents a single distribution from the Fund and is not a representation of the Fund’s total return. The Distribution Rate is calculated by multiplying the most recent distribution by 12 in order to annualize it, and then dividing by the Fund’s NAV.

Technology Sector Risks: The Fund will invest substantially in companies in the technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments.

Electric Vehicle Industry Risk: Companies in the electric vehicle (EV) industry are dependent upon consumer demand for electric vehicles in an automotive sector that is generally competitive, cyclical, and volatile. If the market for electric vehicles (EVs) does not develop as expected, develops more slowly, or if demand decreases, the business prospects, financial condition, and operating results of companies in the EV industry may be harmed.

Electrical Grid Technologies and Energy Solutions Industry Risk: Electric grid and solutions companies are subject to numerous challenges that could significantly impact their financial performance. As the demand for efficient electricity management, renewable energy storage, and innovative power solutions grows, these companies must continuously invest in research, development, and infrastructure to stay competitive. This can lead to high capital expenditures and increased operational costs required for powering market share.

Consumer Discretionary Sector Risk: The success of electrical consumer product manufacturers and retailers is tied closely to the performance of the overall domestic and global economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending, especially when it comes to green or clean renewable energy solutions.

Foreign Securities Risk: Investments in securities or other instruments of non-U.S. issuers involve certain risks not involved in domestic investments and may experience more rapid and extreme changes in value than investments in securities of U.S. companies. Financial markets in foreign countries often are not as developed, efficient, or liquid as financial markets in the United States, and therefore, the prices of non-U.S. securities and instruments can be more volatile.

Animal Spirits Strategy Risks. The Fund’s investment strategy of focusing on companies with strong investor interest carries significant risks. This approach may result in the Fund investing in overvalued securities, as heightened enthusiasm can inflate stock prices beyond their intrinsic value, leaving them vulnerable to sharp corrections. The strategy is influenced by herd mentality, which could lead the Fund to participate in speculative bubbles that may collapse suddenly. Additionally, the strategy often involves a short-term focus, with investments driven by fleeting trends or news cycles, increasing the likelihood of heightened volatility and unpredictability. The Fund may also invest in companies that lack fundamental financial support, relying more on market hype than on sustainable growth or profitability. There is a significant risk of timing errors, as the strategy requires precise entry and exit points to avoid losses. Finally, because the Fund’s strategy is based on a ranking process of companies with strong investor interest, the investment decisions may prove to be poor.

Beta Definition: Beta is the measure of the risk or volatility of a portfolio or investment compared with the market as a whole.

Active Share. Active Share is a measure of how much a portfolio’s holdings differ from its benchmark index.

Basis Point. A basis point is a unit of measure used in finance to describe percentage changes or differences in interest rates, bond yields, or other percentages.

Alpha: Measures the excess return or “outperformance” of an investment. Measures the excess return or “outperformance” of an investment.

Pure Exposure: The Index is a rules-based composite index that tracks the market performance of companies, listed on global stock exchanges, that derive their revenues from producing high-performance AI semiconductors, and building and operating AI-enabled applications and datacenters.

High Beta: Refers to a security or portfolio that is more volatile than the overall market.

Under normal circumstances, the Fund will invest at least 80% of the Fund’s net assets (plus borrowings for investment purposes) in AI companies. The Fund may invest up to 20% of its net assets in companies that are not included in the 80% test noted above. These investments can include equity securities and depositary receipts of issuers that are not Index constituents but that the Sub-Adviser would characterize as emerging AI companies, based on the Sub-Adviser’s analysis of publicly available business plans and as may be further evidenced by capital expenditures, research and development efforts and business acquisitions. This 20% of the Fund’s portfolio may also be invested in cash or cash equivalents (including money market funds).

Artificial Intelligence Risk: Issuers engaged in artificial intelligence typically have high research and capital expenditures and, as a result, their profitability can vary widely, if they are profitable at all. The space in which they are engaged is highly competitive and issuers’ products and services may become obsolete very quickly. These companies are heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. The issuers are also subject to legal, regulatory and political changes that may have a large impact on their profitability. A failure in an issuer’s product or even questions about the safety of the product could be devastating to the issuer, especially if it is the marquee product of the issuer. It can be difficult to accurately capture what qualifies as an artificial intelligence company.

Foreside Fund Services, LLC, Distributor.