24 Oct 2025

VistaShares Announces October 2025 Distributions for the Target 15 Family of ETFs

NEW YORK & SAN FRANCISCO & BOSTON (October 24, 2025) –

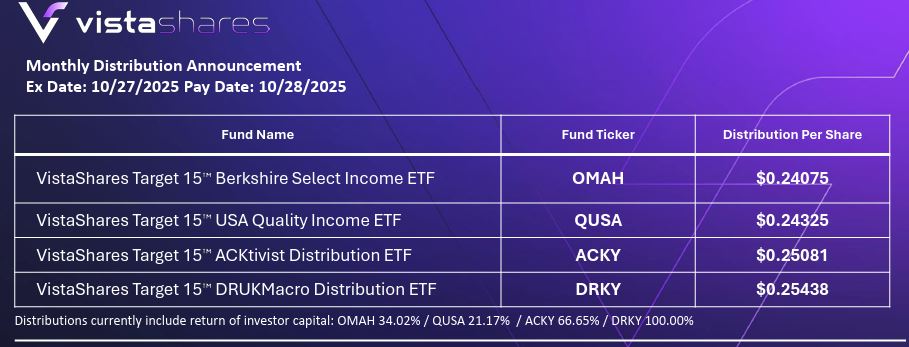

VistaShares, an innovative asset manager seeking to disrupt the status quo in thematic exposures, income investing, and more, is today announcing the monthly distribution amounts for its VistaShares Target 15 DRUKMacro Distribution ETF (DRKY), VistaShares Target 15 ACKtivist Distribution ETF (ACKY), VistaShares Target 15™ Berkshire Select Income ETF (OMAH), and VistaShares Target 15 USA Quality Income ETF (QUSA).

Distributions currently include a return of investor capital. ROC: OMAH 34.02% / QUSA 21.17% / ACKY 66.65% / DRKY 100.00%

For more information and updates from VistaShares, please visit www.VistaShares.com and follow the firm on Linkedin @VistaShares, and on X @VistaSharesX.

About VistaShares

At VistaShares, we strive to deliver innovative investment solutions for today’s investors, helping them navigate evolving market opportunities with confidence. VistaShares ETFs are actively managed by industry and investment experts, offering two distinct strategies. Our Pure Exposure™ ETFs target technology-driven economic Supercycles® that we believe are poised for significant growth. Additionally, our Target 15™ option-based income ETFs are designed to generate high monthly income while complementing a core equity portfolio.

The Distribution rate is the estimated payout an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. The Distribution Rate is calculated by multiplying an ETF’s Distribution per Share by twelve (12), and dividing the resulting amount by the ETF’s most recent NAV. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Distributions are not guaranteed.

The Distribution rate and 30-Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may differ significantly from its Distribution Rate or 30-Day SEC Yield. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs (if any) are variable and may vary significantly from month to month and may be zero. Accordingly, the Distribution Rate and 30-Day SEC Yield will change over time, and such change may be significant. The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment. These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future.

Index / Strategy Risks. The Index’s holdings are derived from publicly available data, which may be delayed relative to the then current portfolio of Berkshire Hathaway, Pershing Square Capital, or Duquesne Family Office. Consequently, the Fund’s holdings, which are based on the Index, may not accurately reflect their most recent publicly-disclosed investment positions and may deviate substantially from its actual current Portfolio. The equity securities represented in the Index are subject to a range of risks, including, but not limited to, fluctuations in Market conditions, increased competition, and evolving regulatory environments, all of which could adversely affect their performance.

Focused Portfolio Risk. The Fund will hold a relatively focused portfolio that may contain exposure to the securities of fewer issuers than the portfolios of other ETFs. Holding a relatively concentrated portfolio may increase the risk that the value of the Fund could go down because of the poor performance of one or a few investments.

Distribution Risk. Although the Fund has an annual income target, the Fund intends to distribute income on a monthly basis. There is no assurance that the Fund will make a distribution in any given month.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes.

Options Contracts Risk. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the option contract and economic events.

Equity Market Risk. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value.

U.S. Government and U.S. Agency Obligations Risk. The Fund may invest in securities issued by the U.S. government or its agencies or instrumentalities. U.S. Government obligations include securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, such as the U.S. Treasury.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective Investors do not have a track record or history on which to base their investment decisions.

Newer Sub-Adviser Risk. VistaShares is a recently formed entity and has limited experience with managing an exchange-traded fund, which may limit the Sub-Adviser’s effectiveness.

Swap Agreements Risk: Swap agreements are entered into primarily with major global financial institutions for a specified period which may range from one day to more than one year. In a standard swap transaction, two parties agree to exchange the return (or differentials in rates of return) earned or realized on particular predetermined reference or underlying securities or instruments.

High Monthly Income Disclosure: There is no guarantee of how the Fund will perform in the future. There is no assurance the Fund will make a distribution in any given month and the following may vary greatly.

30-Day SEC Yield: The 30-Day SEC Yield represents net investment income, which excludes option income, earned by the Fund over the 30-Day period ended at the most recent month-end, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-Day period.

Distribution Rate: The annual rate an investor would receive if the most recent fund distribution remained the same going forward. The Distribution Rate represents a single distribution from the Fund and is not a representation of the Fund’s total return. The Distribution Rate is calculated by multiplying the most recent distribution by 12 in order to annualize it, and then dividing by the Fund’s NAV.

Not affiliated with Berkshire Hathaway, Warren Buffett, Pershing Square Capital, Bill Ackman, Duquesne Family Office, or Stanley Druckenmiller.

Foreside Fund Services, LLC, Distributor.